1098-T Information

1098-T Tax Reporting

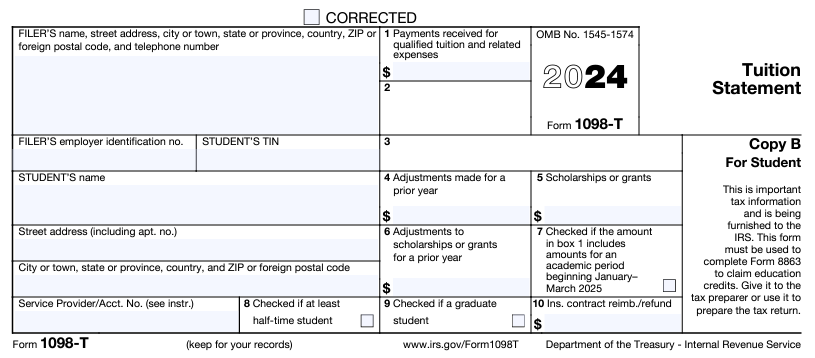

Tax time is right around the corner. Your 1098-T, or "Tuition Payment Statement," is an important document that helps prove eligibility for student tax benefits, which may lower your tax liability.

Changes from 2018 Forward

In previous years, your 1098-T included a figure in Box 2 that represented the qualified tuition and related expenses (QTRE) we billed to your student account for the calendar (tax) year. Due to a change to institutional reporting requirements under federal law, beginning with tax year 2018, we will report in Box 1 the amount of QTRE you paid during the year.

Depending on your income (or your family’s income, if you are a dependent), whether you were considered full or half-time enrolled, and the amount of your qualified educational expenses for the year, you may be eligible for a federal education tax credit. (You can find detailed information about claiming education tax credits in IRS Publication 970, page 9.)

The dollar amounts reported on your Form 1098-T may assist you in completing IRS Form 8863 – the form used for calculating the education tax credits that a taxpayer may claim as part of your tax return.

EGCC is unable to provide you with individual tax advice, but should you have questions, you should seek the counsel of an informed tax preparer or adviser. Below is a blank sample of the 2024 Form 1098-T, that you will receive in January OR February 2025, for your general reference. For more information about Form 1098-T, visit https://www.irs.gov/pub/irs-pdf/f1098t.pdf.

The 1098-T is an informational form only and claiming the correct deductions is the responsibility of the student. We encourage that you keep all your receipts of payments made towards your schooling and present to your Tax Professional for assistance in completing your tax return.

Frequently Asked Questions

- Q: Not sure why you received a tax form 1098-T?

- A: The 1098-T form is a "Tuition Payments Statement" that higher educational institutions are required by federal regulations, to provide to eligible students and the IRS. For more information please consult a tax professional or the IRS website at https://www.irs.gov/pub/irs-pdf/p970.pdf.

- Q: My SSN is wrong on my form. Can I have a new one sent to me?

- A: Some students may have incorrect SSN or taxpayer identification information on file if they either did not know or did not have accurate taxpayer identification information at the time they applied to the College. If your SSN is incorrect, you will need to contact the Registrar’s Office. Then, contact the Business Office to request an updated form.

- Q: What is the Federal Tax ID number for EGCC?

- A: EGCC federal tax id number is 34-1015707

- Q: How will I know if I am to receive a 1098-T?

- A: Once the 1098-Ts are processed and available (typically mid to late January), an email will be sent to your student email account stating so. This email will also include instructions as to how to retrieve an electronic copy if you wish to do so.

Some of the Most Common Reasons You did not receive a 1098-T Form

- If you had no payments posted in 2024 that applied to qualified charges for tuition and related expenses.

- If financial aid (e.g., scholarships, grants, military educational benefits payments, other tuition benefits) covered all your tuition and related expenses for the year.

- If academic credit was not obtained in the calendar year for which the 1098-T is generated.